Customer Unified Performance Exchange (CU-PX) Banking and Financial Services are deeply intertwined with customer service because their products and services—such as savings accounts, loans, investments, insurance, and credit—are highly personalized and trust-based.

Here’s an overview of customer service within these industries:

Key Aspects of Customer Service in Banking & Financial Services:

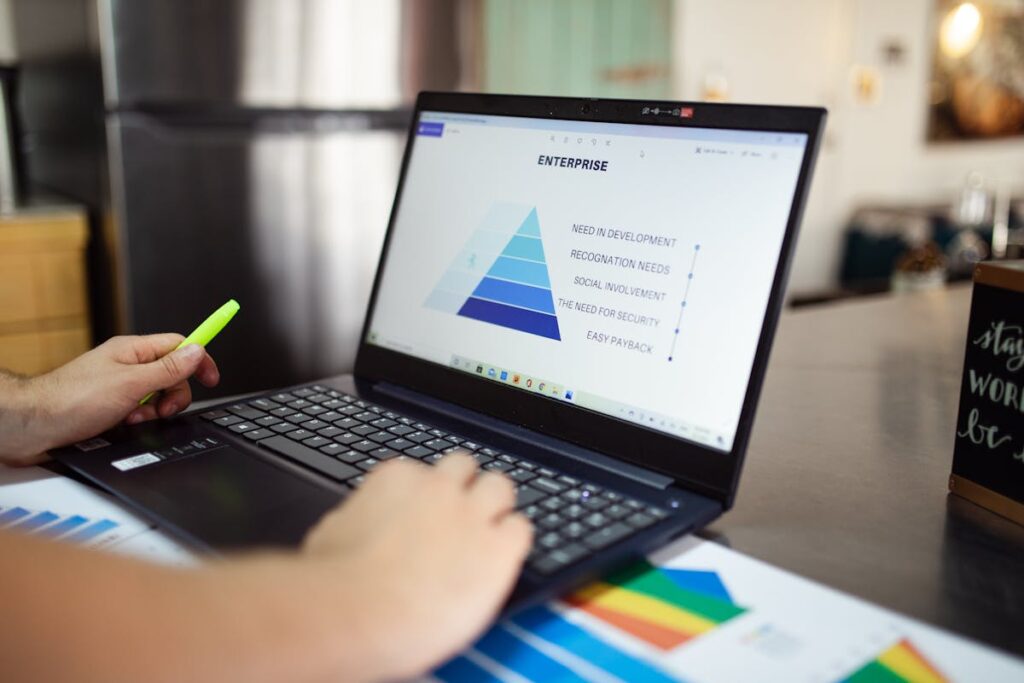

1. Customer-Centric Approach

- Focus on understanding customer needs and offering tailored solutions.

- Personalized service, such as customized loan packages or investment advice.

- Building long-term relationships fosters loyalty and trust.

2. Digital Transformation

- Use of mobile apps, online banking, and AI-powered chatbots to provide seamless 24/7 support.

- Omnichannel communication, enabling customers to connect via phone, email, chat, or in-person.

3. Compliance and Security

- Ensuring transparency in transactions and fees.

- Offering secure digital platforms to protect customer data and prevent fraud.

- Adhering to financial regulations to maintain trust.

4. Proactive Service

- Anticipating customer needs, such as reminders for loan repayments or upcoming fees.

- Providing insights like spending analysis or investment recommendations.

5. Handling Complaints and Grievances

- Quick resolution of issues related to account errors, fraud, or delays.

- Empowering customer service teams with knowledge and tools to resolve issues efficiently.

- Use of feedback mechanisms to improve service.

Customer Service Trends in Banking & Financial Services:

1. Artificial Intelligence and Automation

- Chatbots and virtual assistants like Siri, Alexa, or dedicated tools such as Erica by Bank of America.

- Automated fraud detection and alerts.

2. Data-Driven Insights

- Using customer data to offer hyper-personalized products and services.

- Predictive analytics to identify financial needs before the customer expresses them.

3. Focus on Financial Literacy

- Offering resources and tools to educate customers about managing finances.

- Enhancing the overall customer experience by empowering users with knowledge.

4. Sustainability and Ethics

- Many banks and financial services are adopting green banking practices.

- Customers are increasingly valuing transparency and ethical practices.

- Most of the challenges in customer Service our customers face:

- Managing diverse customer expectations across demographics.

- Balancing automation with a human touch for sensitive issues.

- Adapting to rapid technological advancements while ensuring inclusivity.

Our best Practices:

- Empathy and Active Listening: Essential in understanding and resolving customer concerns.

- Continuous Training: Equipping customer service representatives with updated financial knowledge and tools.

- Feedback Integration: Actively incorporating customer feedback to refine services.

- Streamlined Processes: Simplifying account setup, loan approvals, or claim processes for convenience.